Introduction

Hypercall is an on-chain options exchange built for real, continuous liquidity. It is designed to be a professional options trading venue: tight spreads, meaningful size, predictable execution, and reliable lifecycle rules.

Options liquidity is constrained by hedging.

If market makers can hedge cheaply and continuously, they can quote tighter and larger across more strikes and expiries. Hypercall achieves this by anchoring option liquidity to deep perpetual liquidity via Hyperliquid.

Fractional options trading is supported down to the minimum trade size, so positions can be sized precisely.

Use Cases

Take Profits and Hedge

- Hedge spot and perp exposure without selling underlying assets

- Use spreads and delta neutral positioning to reduce portfolio shocks

Go Long or Short Volatility

- Express views across market regimes using straddles, strangles, butterflies, and iron condors

- Capture time decay with calendar spreads

Make Markets

- Quote tighter markets when delta hedging is efficient

- Use portfolio margining that recognizes offsets across spot, perps, and options

Why Hypercall Can Support Deeper Liquidity

Most on-chain options venues fail on the same bottleneck:

- Market makers must warehouse risk or hedge against thin spot or imperfect venues

- Spreads widen, size collapses, and listings become one-asset hobbies

Hypercall removes the primary constraint by enabling market makers to delta hedge option exposure on deep perp markets.

This unlocks:

| Benefit | Description |

|---|---|

| Tighter spreads | Lower hedge friction reduces quoting costs |

| Larger quote sizes | Less inventory bottleneck enables more size |

| Complete surfaces | More strikes and expiries with two-sided markets |

| Scalable liquidity | Grows with underlying market instead of fragmenting |

Relationship to Hyperliquid

Hypercall anchors options execution to Hyperliquid spot and perp liquidity so options pricing and risk management can scale with the underlying market.

Hyperliquid provides the delta engine beneath the options venue. Options liquidity improves as perp liquidity improves, because quoting is anchored to a real hedge venue instead of an isolated book.

How Hyperliquid powers Hypercall:

- Delta hedging path — Option market makers hedge exposure using Hyperliquid perps

- Market data inputs — Hyperliquid spot, perp marks, and oracle feeds are used for pricing inputs and lifecycle logic

- Perp compatibility — Hypercall supports perp order routing using Hyperliquid-compatible semantics where required

- Deep liquidity — Market makers can quote tighter options markets because delta hedging has a reliable venue

- Portfolio impact — Traders can evaluate how options change their net exposure alongside existing Hyperliquid positions

How Hypercall Works

Hypercall is powered by an execution plus risk architecture built for professional market making and for integrators who want options as a backend.

Hypercall Owns

- Options venue: order intake, risk checks, matching

- Lifecycle transitions from open to expiry to settlement

- Deterministic risk enforcement across all frontends

- One shared options market for all integrators

Market Makers Own

- Delta hedging on Hyperliquid perps

- Hedge execution (external but assumed by quoting model)

- Quoting strategy and inventory management

Core Pillars

1. Execution and Risk Engine

Hypercall provides the core exchange primitives:

- Options order intake and validation

- Deterministic risk checks and constraints

- Matching and lifecycle rules from open to expiry to settlement

- Controlled liquidation and transfer behavior as specified in the risk docs

2. Market Maker Surface

Hypercall is built for professionals:

- Quoting workflows and interfaces

- Reconciliation for orders, fills, and positions

- Exposure visibility and operational controls

- Monitoring expectations and failure handling patterns

3. Integrator Backend

Hypercall is built to be embedded into other products:

- Partner-facing REST and WebSocket APIs

- Consistent auth and signing patterns using EIP-712

- One shared liquidity pool across all integrators without fragmentation

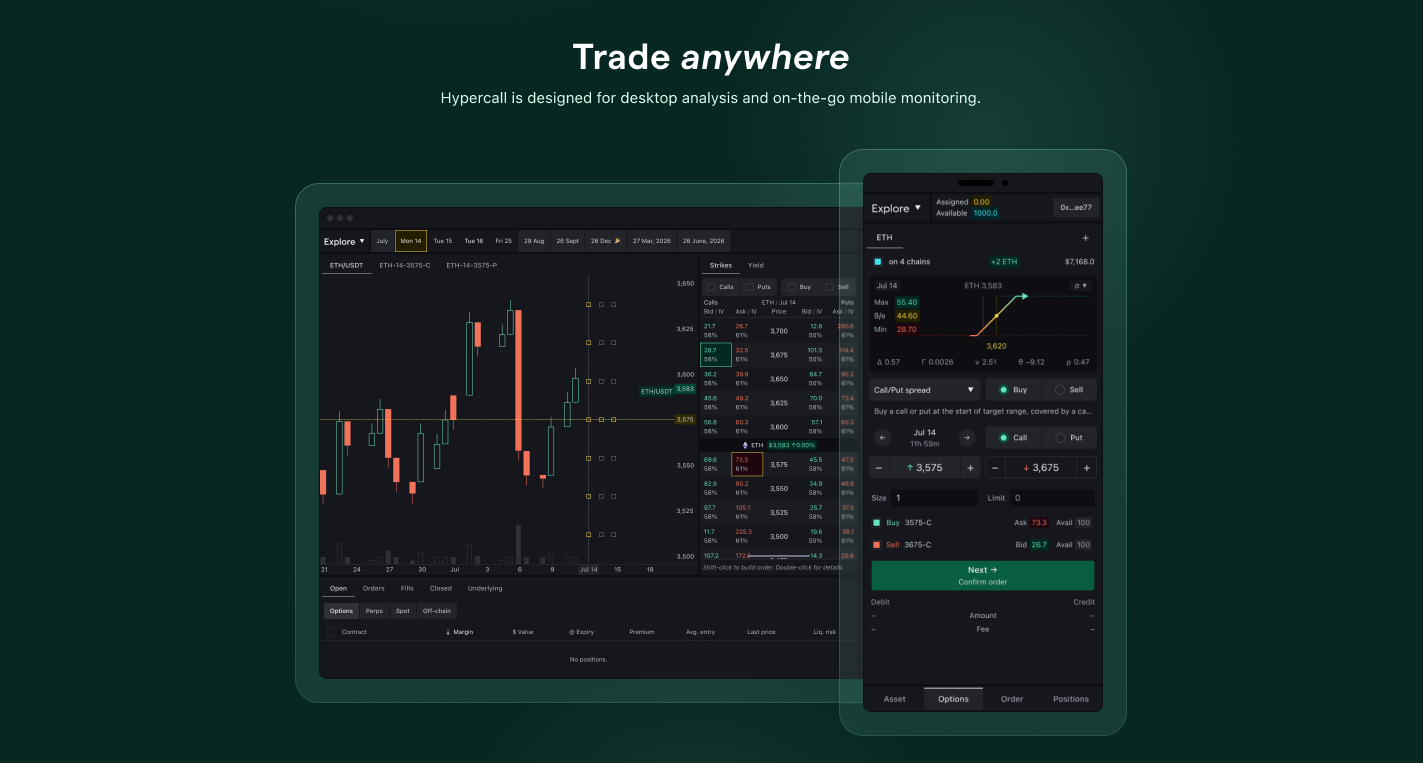

Interface and UX

Hypercall is designed for fast, clear execution with a simple, retail-friendly flow. The goal is Robinhood-standard usability without sacrificing options depth.

- Clean order entry — Portfolio views that surface risk and exposure

- Strategy workflows — Common options structures made easy

- Cross-platform — Consistent experience across desktop and mobile

- Mobile-first order flow — Clear Buy/Sell, Call/Put, expiry tabs, and single-action trades

- Desktop layout — Chart, chain, and order ticket combined so decisions stay in one view

Get Started

Choose the path that matches your role:

Market Maker

Integrator

Why Hypercall

- Liquidity scales with hedge depth — Market makers can hedge delta where liquidity already exists (Hyperliquid perps) instead of relying on thin spot or isolated surfaces

- One shared options market — Integrators and frontends do not create separate liquidity pools; flow is concentrated

- Deterministic risk semantics — Margin enforcement and lifecycle rules are explicit and consistent

- Operator-grade integration surface — REST and WebSocket designed for real-time quoting, reconciliation, and observability